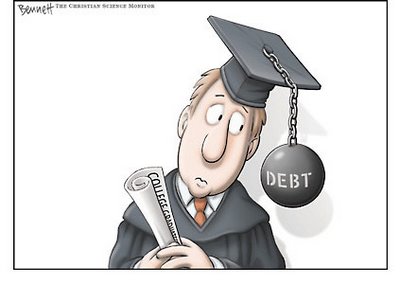

Death, taxes and college debt: what Pell Grant cuts mean for students

May 13, 2015

“Our new Constitution is now established, and has an appearance that promises permanency; but in this world nothing can be said to be certain, except death and taxes.”

That is the famous quote by Benjamin Franklin, and his words still ring true today. College students, however, have found a third certainty of this world, and that is student loans. Loans to college students are a multi-billion dollar industry, in which the U.S. government has long been a major player in.

Recently, Republicans in Congress have proposed deep cuts to multiple higher education spending programs as part of their spending blueprint for the 2016 fiscal year. According to the National Association of Independent Colleges and Universities, the cuts could remove $150 billion from federal student aid over the next decade and would slash the maximum available Pell Grant award by nearly $1000 dollars. To make matters worse, the plan would reduce the number of benefits available to student-loan borrowers and could potentially involve charging interest on student loans of low-income students while they are still in school.

Lynette Wahl, Director of Financial Aid here at Hamline, filled in the details about the number of students who might be affected by these cuts.

“If the Pell Grant is cut it could impact about 36% of Hamline undergraduate students, or about 839 students at Hamline who currently have Pell grants. If the interest subsidy is cut as well, nearly 600 more students would be affected,” she said.

Gail Nosek, Hamline’s Public Relations and Social Media Director, is one of the leaders at Hamline of the attempt to raise awareness about this situation with students. She explained how she got involved in this effort.

“The National Association of Independent Colleges and Universities recently contacted Hamline, as well as their other partner institutions across the country, with information about the Save Student Aid Campaign which they developed with the Student Aid Alliance,” she said.

In trying to emphasize all points of these potential cuts, Wahl wants students to learn about what could happen both in the short term and the long-term.

“The cuts to Pell Grants get the most press, and impact students up front. The possible cuts to the interest subsidy on loans, changes to the interest driven repayment plans, including possible elimination to the public sector loan forgiveness plan, could be very costly to students in the long term,” she said.

Nosek has a few suggestions about how students who are interested in becoming active in preventing the cuts.

“Students can write their legislators to share personal stories about how important student aid is to them and how the proposed cuts could impact their lives. The Hamline community can also help spread the word through social media by posting their opposition to the cuts and using #SaveStudentAid on Facebook and Twitter. Follow Student Aid Alliance on Facebook and Twitter for future updates and more information on the program, and check out the Student Aid Alliance Website at act.studentaidalliance.org.”